WHICH PRESIDENT WILL BRING PROSPERITY TO YOUR HOME?

Supply Side Economics vs. What Ever Biden-Harris Are Doing Is Called

For several weeks, Donald Trump has been stumping in part with a proposal to eliminate taxes on tips. It’s a popular idea among both workers who rely on tips as a substantial part of their income and with politicians on both sides of the aisle. The latter most likely because it’s an impossible income source to quantitate with any degree of accuracy. Why? Because there are millions of Americans who as I do may pay with a credit or debit card but tip only with cash. While card transactions are easy to track cash is not. But we need to look beyond tips. We need to finally come to grips with two very different approaches to managing the economy of the United States and decide once and for all under which system do you and your family prosper?

On one side Conservatives argue that if businesses are free from the constraints of stifling taxes they will prosper and grow and when businesses expand they need more employees. More employees means more payroll checks and more payroll checks mean more tax revenue. AND when businesses are expanding and need more employees they will have to compete with other business for those employees. Competition for employees means full employment, higher wages, and an increase wage related taxes collected. But more importantly when wages increase so does spending. Consumer spending drives business expansion.

On the other side, Progressives (they’re really socialists) call that “trickle down economics”. Why? Because business profits increase and IF business profits increase so does the value of their stocks which means that all those lazy stockbrokers and hedge fund managers and the C-level corporate staff are getting stinking rich at the expense of the sweat off their employee’s brows who are paid a pittance of what they’re really worth. And exactly what is the labor of those employees really worth? Why, no less than what the CEO earns. It is a system that has failed each and every time that it’s been tried. Just ask the Russian coal miner and the Chinese factory worker. OR closer to home, look at any number of South American nations that bought into the myth of socialism only to be rewarded with a never ending series of acts of civil disobedience and revolutions because all of their earnings went to the state.

Never the less the left continues to disparage supply side economics a series of emotional diatribes. But this is economics and in economics only numbers matter.

So what were the real elements of the Trump 45 tax plan and did it work?

“…the Tax Cuts and Jobs Act (TCJA),[3][4] that amended the Internal Revenue Code of 1986. The legislation is commonly referred to in media as the Trump tax cuts, as it was a key agenda piece of the Trump administration. Major elements of the changes include reducing tax rates for businesses and individuals, increasing the standard deductionand family tax credits, eliminating personal exemptions and making it less beneficial to itemize deductions, limiting deductions for state and local income taxes and property taxes, further limiting the mortgage interest deduction, reducing the alternative minimum tax for individuals and eliminating it for corporations, doubling the estate tax exemption, and reducing the penalty for violating the individual mandate of the Affordable Care Act(ACA) to $0.[5][6] The New York Times has described the TCJA as "the most sweeping tax overhaul in decades".[7]

For those of use who have memories beyond the latest disclosure of another Tim Walz bizarre history of both personal and political misadventures, we remember quite well that despite what the progress left is telling you that Donald Trump saw to it that only billionaires were the beneficiaries of his tax cuts — in reality Donald Trump oversaw most prosperous era since or personal economic growth since the Roaring Twenties. And here is the proof.

Look closely at the very last few years beginning in 2015. In 2015 despite messaging from the left that they were doing great job managing the economy, real per capita income fell by about three percent. The big spike in personal income that followed the 2015 decrease is directly attributable to the Trump Era Tax Cuts and Jobs Act. And the plunge in real personal income from 2020 to 2023? In just that three year period real per capita income decreased by almost 12%. Thank you Joe Biden and Kamala Harris.

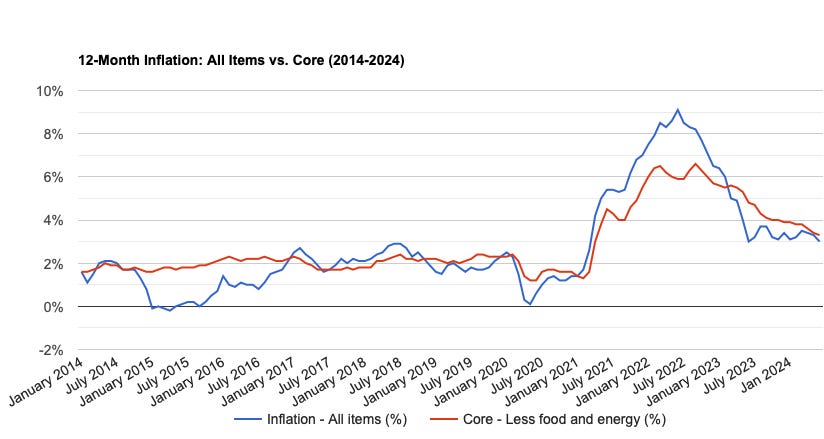

But that’s not the whole story. Between 2016 and 2019, the Trump Era, inflation averaged 1.9%. During the Biden Era inflation is almost three times greater averaging 5.6%. Inflation is important because it has the same effect as devaluation of the dollar, that is it takes more dollars to buy the same product you purchased just last year.

And here, from the same source as the Inflation Calculator, is a graphical rendering of inflation during the Biden - Harris years. Feel free to compare it to the Trump years 2016 -2020.

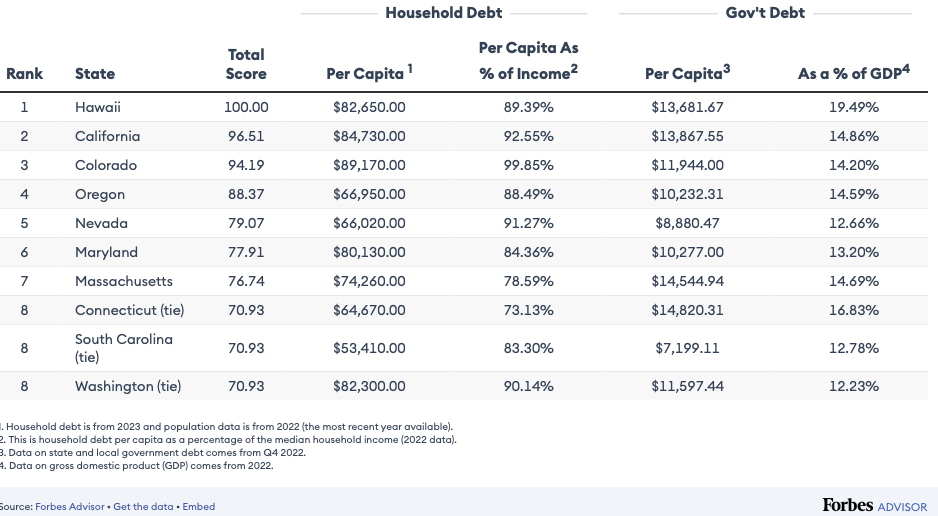

So which of these two approaches to managing the nations economy make financial sense to you and me? I hope that was rhetorical. Because a Harris-Walz administration will tax you and me into oblivion just like Walz has done in Minnesota and every democrat governor has done in their state. I’ve provided the data for the top 20 states you can find the rest here. But of the top 20 only 5 have republican governors.

What is interesting about the debt in Minnesota is that when Walz came into office Minnesota had a $17.6 Billion surplus. By the end of his first year as governor Walz and his democrat majority had reduced that surplus by more than half to just $7 Billion. They did that not by returning it to the people from whom it came but by spending. You can read about the different views of the state’s democrat and republican legislators for yourselves here.

What is important about the Minnesota data is the extent of the personal debt relative to the average Minnesotans income -it is more than 75% of their per capita income and the percentage of their income needed to pay their share of the state’s debt is almost 13% of their per capita income.

While Kamala Harris has never had responsibility for managing a state or federal budget like either Trump or Walz something she does bare some responsibility for is the amount of the federal debt. This is her tie breaking vote on the disastrous COVID relief bill.

According to the Forbes report, in 2022 the United States was the second most indebted nation in the world — sporting a 121.38% debt to GDP ratio.

The choice should be clear to everyone. Do we want to be America or Minnesota?

Union, Kentucky

11 August 2024

Stop making sense!

Something worth looking at is people with liberal arts degrees. In my experience, they very nearly exclusively are the ones who salivate over increased taxes. In my experience, they are the ones who get their jobs and their paychecks directly from government, or thru NGOs and other organizations deriving income directly from the government teat. Coincidence? I don't think so.